A monthly budget planner is an essential tool to help you track your income, expenses, and saving goals. Having a budget gives you control over your finances so you can make intentional spending decisions aligned with your values and priorities. Budgeting prevents overspending and helps you save money for future goals like an emergency fund, vacation, or down payment on a house. In this article we talk about How To Create A Monthly Budget Planner.

This comprehensive guide will walk you through the key steps to create your own easy-to-use monthly budget planner tailored to your unique financial situation. With some basic supplies and a bit of time, you’ll have a customized budget that provides visibility into where your money goes and helps you achieve financial freedom.

Supplies Needed

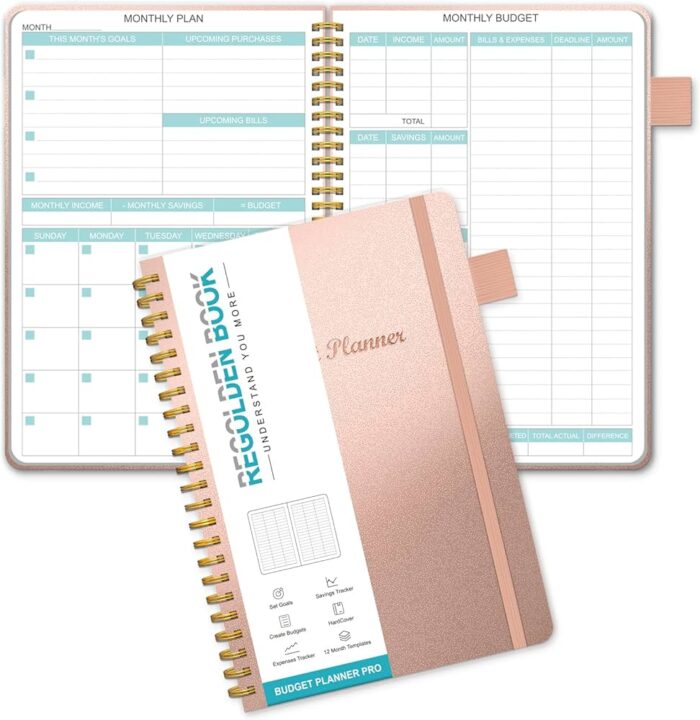

- Budget planner template printed out or notebook/journal

- Writing utensils (pens, highlighters)

- Calculator

- Access to bank statements and billing accounts

Set Up Monthly Income Section

Your budget planner’s initial part monitors your monthly income. This comprises the amount of your net compensation after deductions and taxes. Include any additional monthly income you receive from freelance work, child support, or rentals. Add up all of the revenue streams that you receive each month.

List Your Monthly Expenses Normally

Next, make a list of all of your regular monthly expenses that are usually the same. These consist of items such as:

- Housing: insurance, property taxes, rent or mortgage

- debt repayment for credit cards, auto loans, and education loans

- Utilities: phone/internet, cable, gas, electricity and water

- Health, auto, and renters’ or homeowners’ insurance

- Gas, passes for public transportation, and parking

- Child support and childcare

- Workout, streaming, and subscriptions

To precisely report the quantities of your expenses, consult your billing accounts and bank statements. For easier tracking, group spending into the same categories as mentioned above.

Develop the Section for Variable Expenses

Variable costs fluctuate from month to month and can be cut to help keep your budget in balance. Enumerate costs such as:

- groceries and eating out

- Recreation, pastimes, and free time pursuits

- Personal care: attire and salon visits

- Other: veterinary expenses, housewares, presents

Once more, look over previous statements to find the average monthly cost of variable items. If you want a deeper understanding of how and where your variable money is spent, try keeping a one-month spending log.

Include Savings Objectives

Savings planning is a crucial component of any monthly budget. This helps you achieve your future financial objectives and acts as a safety net against unforeseen costs. Figure out how much of your monthly income you can actually save, then add savings categories such as:

- Fund for emergencies

- investments for retirement

- Fund for a down payment

- vacation savings

- Make space in your budget for these savings to increase over time.

- Determine the Sums for Every Category

The final step is to sum the income, fixed spending, variable expenses, and savings for each budget category using a calculator. Compare your net income to your entire monthly costs, including savings.

Ideally, your expenses and savings contributions will be less than your income. If expenses are higher, look for places to cut back variable spending. If you consistently spend above your means each month, reducing fixed costs may require bigger lifestyle changes.

Updating and Balancing Your Budget

The real work begins once your budget template is set up. Review your budget weekly and update category totals and progress towards savings goals.

Track your actual spending to stick within the amounts budgeted for monthly expenses. If you go over budget in dining out, reduce next month’s budget to balance it or increase your income.

Use your budget as a living document and financial roadmap. Celebrate small wins like finally building that emergency fund or paying off a credit card. Revisit your budget monthly or quarterly to account for changes in income, expenses, or savings targets.

Budgeting Tools and Resources

Creating a budget planner takes effort but yields big rewards. There are many free budget templates and tools online to reduce the workload. Resources like Mint, YNAB, EveryDollar, and spreadsheet templates help automate expense tracking and cash flow analysis.

Take advantage of technology to create colorful visual charts that break down spending by category. But a basic handwritten budget works perfectly fine too. Find a system that fits seamlessly into your lifestyle.

Stay motivated by joining online budgeting communities to get tips and share struggles. And work one-on-one with a financial advisor if needing help overcoming money obstacles hindering your budget success.

The Bottom Line

Crafting a monthly budget planner tailored to your financial situation provides structure and awareness of cash inflows/outflows. By spending less than you earn and planning for savings, you can eliminate financial stress and save for the future. Break down building a budget into approachable steps as outlined above. Stick with the process month-after-month to transform your financial life. I sincerely hope you find this “how to create a monthly budget planner” article helpful.